Our basic principles at Uno Minda are to identify ourselves as a company that is sustainable, innovative, and passionate about everything we do. We understand that people are at the core of any successful business, and we aim to develop strong bonds with all of the stakeholders we serve throughout the value chain.

At Uno Minda, we believe that people play a vital role for our growth trajectory.

Investors

Uno Minda’s approach for investors

Uno Minda aspires to give the greatest benefit to investors via steady economic growth, while maintaining awareness about our duties to protect people and our planet.

Capital Impacted

Financial Capital

SDG Impacted

Performance Highlights of FY 2022-23

19.2 %

RoCE

₹798

INR Crores Cash Flow from operations

₹1.5

Dividend Per Share:

Delivering Value following Sustainable Development Ambitions of Our Group

We are dedicated towards responsibly creating the future, as demonstrated by our ESG goals. Our ESG approach will undoubtedly have a major advantageous impact upon our long-term economic growth, making us more resilient in times of turmoil, and support our investors in proactively addressing their ESG risks.

Business Strategy for Sustainable Growth

We have distinct strategic priority areas that allow us to establish ourselves as an industry leader in mobility-related services. It serves as one of the reasons we continue to be the go-to supplier for the country’s biggest OEMs, providing among the best revenue growth and profits, which in turn creates a shareholder value.

Our dedicated investor relations team fosters transparent communication and engagement with investors. They provide timely and accurate information about the Company’s financial performance, business updates, and strategic initiatives. The Company aims to build long-term relationships with investors based on trust and mutual growth.

Approach to Manage Financial Capital

We operate with a framework of efficient cash and flow management. Through our robust risk management processes, we have received good credit rating which has enabled us to raise financing at reasonable rates, whenever required. The main component of our sources of liquidity include cash and its equivalents, as well as cash gained from operations. We are aiming to be debt-free, and we have been undertaking strategic initiatives to cover our operating, as well as managerial requirements, with a considerably evaluation for all unforeseen events. Moreover, we have a healthy finance pipeline, which allows us to record steady revenue across all phases of business.

Value Created for Investors in FY 2022-23

Being able to remain versatile and respond swiftly to shifts in market conditions allowed us to achieve optimum operational efficiency and keep solid financial results throughout the year.

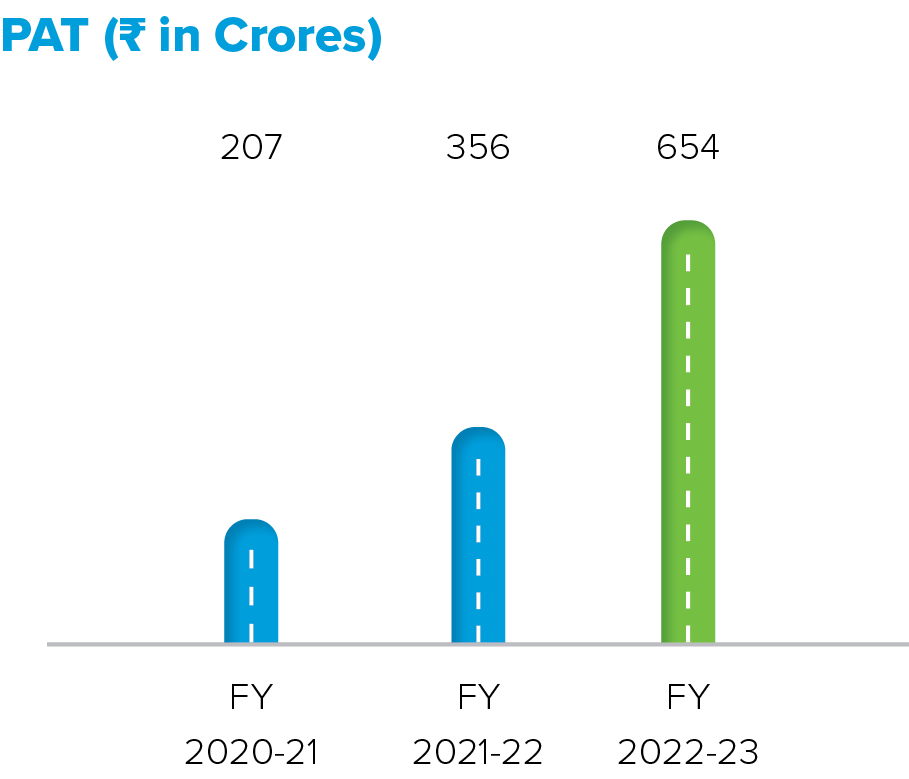

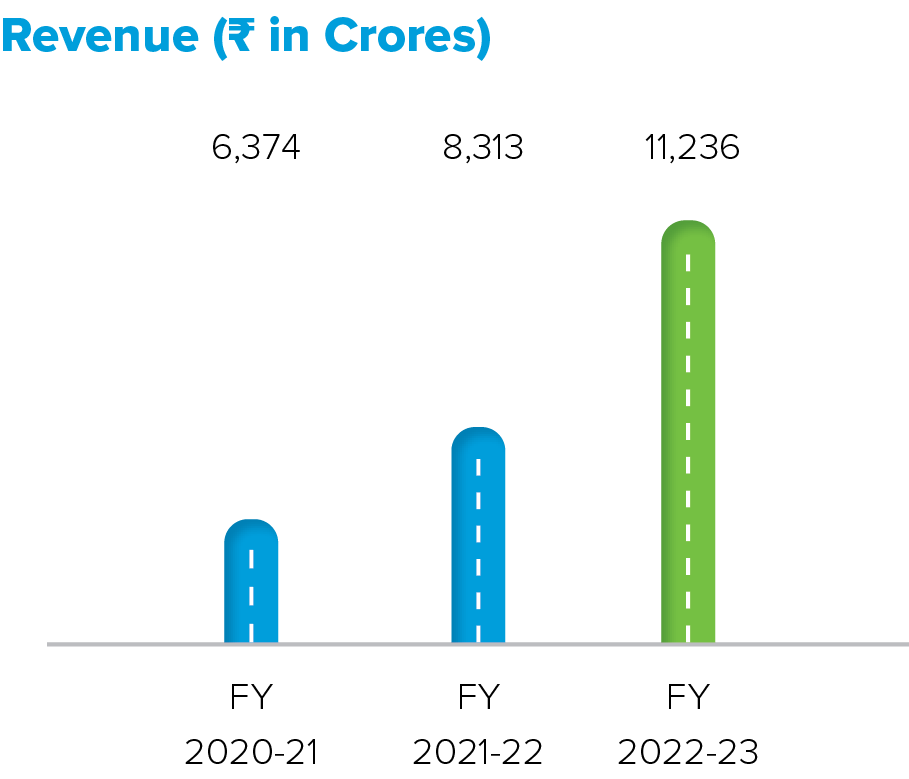

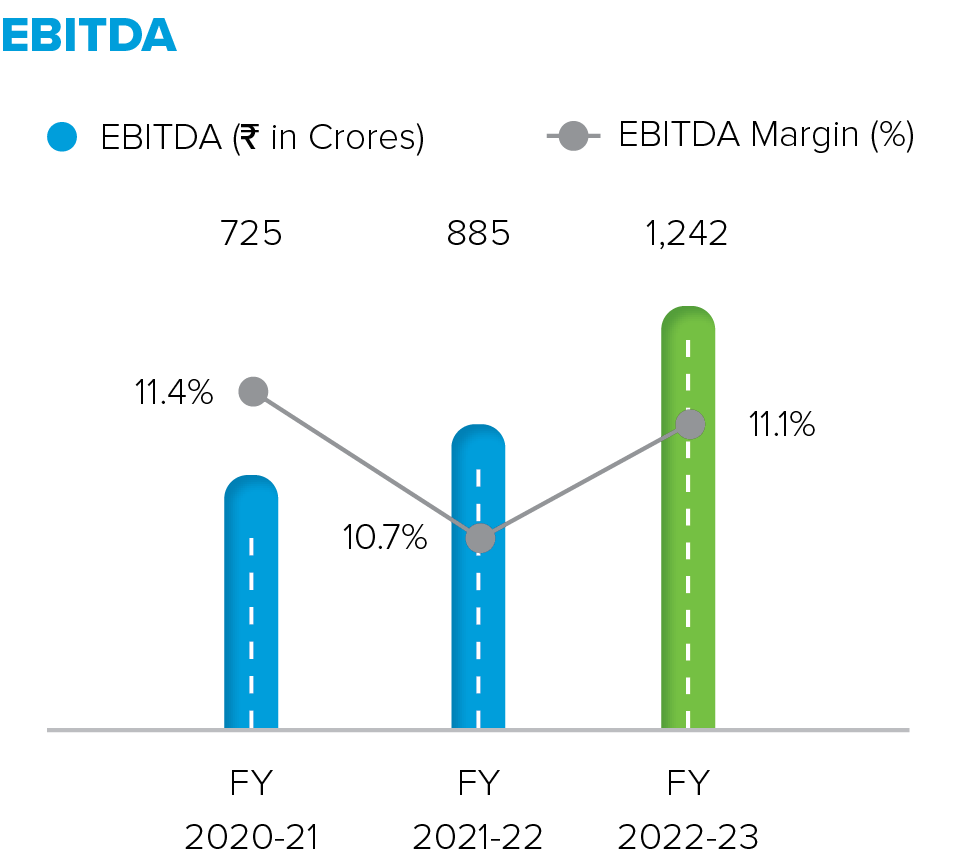

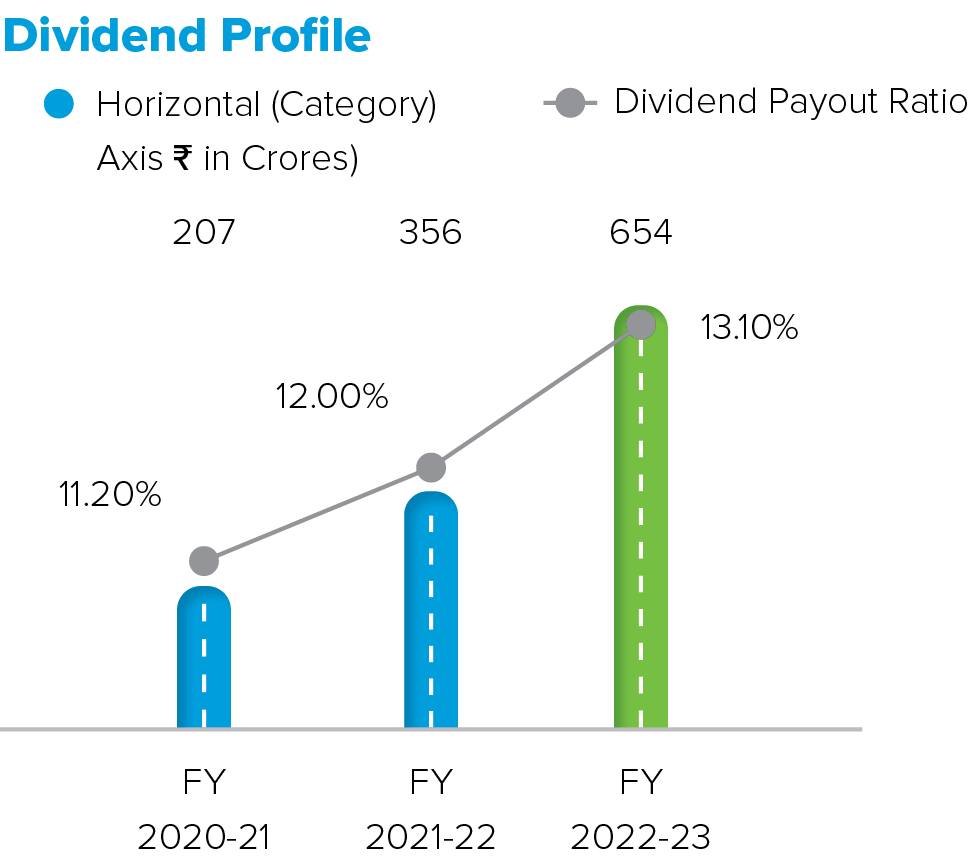

At a consolidated level, the Company reported a strong revenue growth with revenue of ₹ 11,236 Crores for FY23 as against ₹ 8,313 Crores in the previous financial year, registering a rise of 35%. The EBITDA for FY23 has been reported as ₹ 1,242 Crores vis-à-vis ₹ 885 Crores in FY22, growth of 40% with an EBITDA margin of 11.1%. Profit before tax and share of profit/loss of JVs for FY23 stood at ₹ 791 Crores as against ₹ 494 Crores in FY22. PAT (UML Share) for FY 2022-23 stood at ₹ 654 Crores in as against ₹ 356 Crores in FY22, an increase of 84%. Final Dividend of ₹ 1.0 per share, i.e., 50% of face value was recommended for FY23 . Along with interim dividend of ₹ 0.50 per share, the total dividend pay out ratio of the company improved to 13.1%.

Key Performance Indicators

Explanation

In FY22-23, we were able to transform our strong top-line growth into a PAT (UML Share) margin of 5.82% for the year due to better operating leverage and efficient cost management.

Explanation

The Company has demonstrated excellent performance growth in FY 2022-23. Though industry volumes have grown by 13%, we continued our out-performance by registering growth at 35%.

Explanation

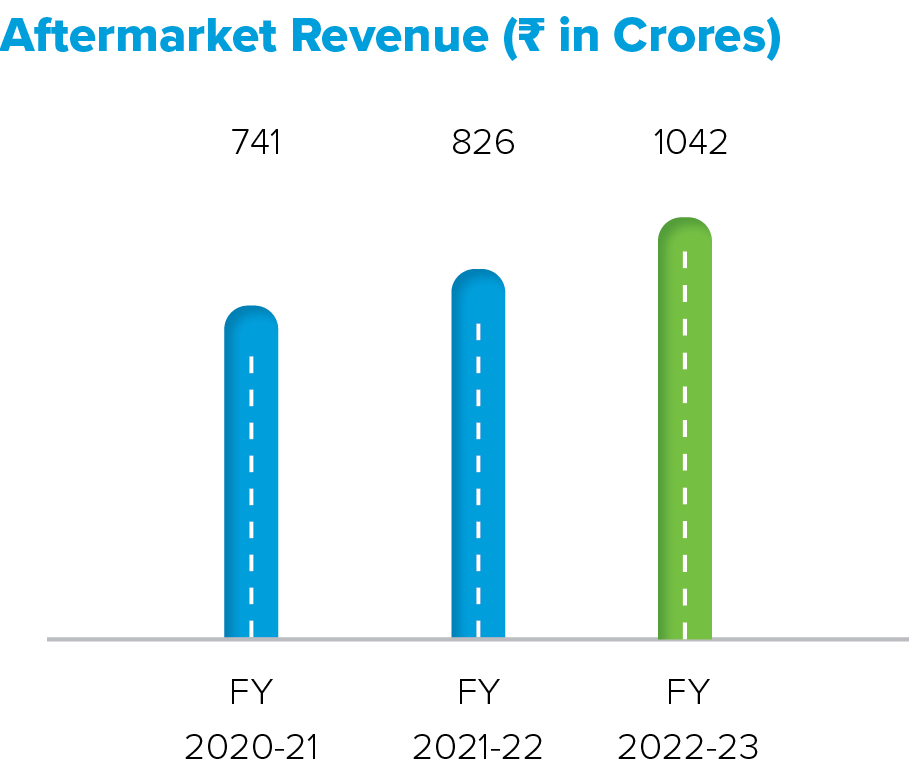

In FY 2022-23, we saw increase in Aftermarket revenue approx by 25% over the same period last year. Our aftermarket division for the first time has crossed ₹ 1,000 Crores mark. We have been continuously strengthening our distribution channels along with successfully running various B2C marketing campaigns We also launched our aftermarket website www.unomindakart.com for retail customers

Explanation

In FY 2022-23, EBITDA increased by 40% owing to higher revenues and better profitability. EBITDA margins also expanded to 11.1% due to benefits of operating leverage partially offset by higher material costs.

Explanation

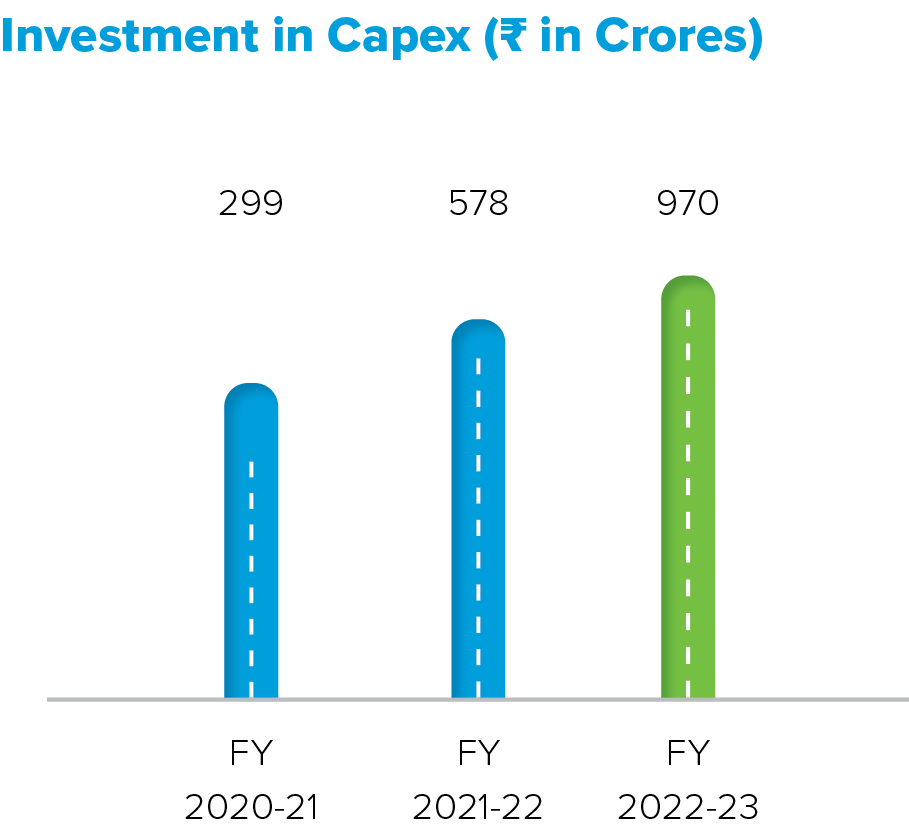

We devoted ₹ 970 Crores in capital expenditures as part of the effort we made to expanding our business, up from ₹ 578 Crores in the year before. The capex for the year also include Land Bank as well as assets of KMA and KMM which got consolidated.

A strong economic performance is vital for ensuring the long-term viability of a business model. A robust economy creates favourable conditions, including increased market demand, revenue growth, access to investment and funding, talent acquisition and retention, and business stability. These factors contribute to the sustainability and growth of businesses, allowing them to thrive and adapt to changing market dynamics. It not only makes it possible to operate a profitable business, but also enables us to satisfy the expectations of our stakeholders and to be accountable for our shareholders’ growth.

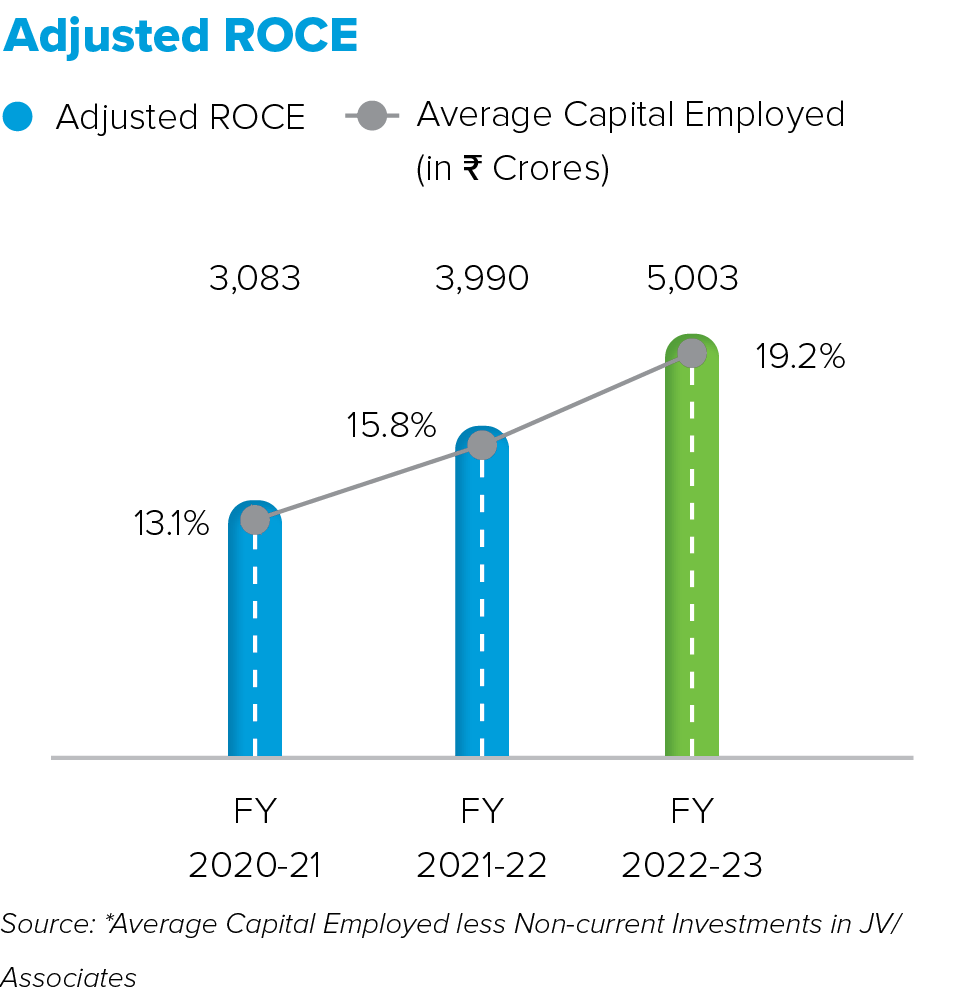

We focus on managing our financial capital prudently to drive sustained economic value generation. Moving forward, we aim to achieve at least a 20% return on capital employed (ROCE) in our business ventures and a minimum market share of 30% in the product markets that we enter.

The Company’s economic value retained of ₹ 567.6 Crores is the direct economic value generated of ₹ 11,236 Crores by the activities of our business and employees, less economic value distributed of ₹ 10,668 Crores to stakeholders through operating costs, employee wages, and benefits, payments to providers of capital, payments to governments and community investments.

Explanation

During FY 2022-23, we remained dedicated to optimising shareholder value, delivering a dividend payment of ₹ 1.5 per equity share (with a face value of ₹ 2), improving our dividend pay out ratio to 13.1% as against 12% last year.

Explanation

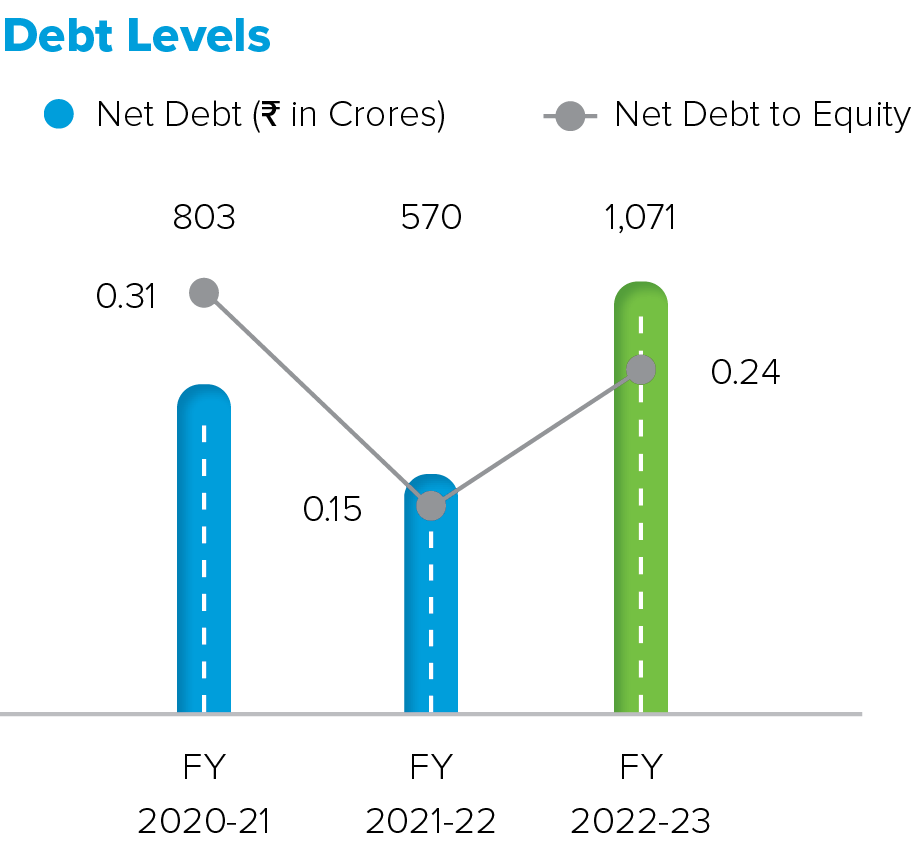

During FY 2022-23, Net debt has increased primarily on account of increase working capital requirements with increase in scale of operations, expansion in capacities and capabilities to cater to future demand, investment in joint ventures and acquisition of land for existing and future projects.

Free Cash Flow

Net Worth

Return on Equity

Top 10 Shareholders by % of Holding - Non-Promoters

| Category/Company | Number of Shares as of 31 March 2023 | % |

|---|---|---|

| Canara Robeco Mutual Fund | 1,56,74,738 | 2.74 |

| Axis Mutual Fund | 1,21,11,132 | 2.11 |

| SBI Mutual Fund | 96,36,789 | 1.68 |

| DSP Mutual Fund | 93,40,491 | 1.63 |

| IDFC Mutual Fund | 89,14,767 | 1.56 |

| ICICI Mutual Fund | 74,43,924 | 1.30 |

| Invesco Mutual Fund | 57,08,392 | 1.00 |

| HSBC Mutual Fund | 40,83,695 | 0.71 |

| HDFC Life Insurance Company Limited | 39,33,879 | 0.69 |

| Bajaj Holdings & Investments Limited | 35,96,626 | 0.63 |