Ethical

Business Conduct

Philosophy

We believe that good corporate governance serves as the foundation upon which businesses can thrive and achieve their long-term goals. The corporate governance at our organisation plays a crucial role in fostering trust, transparency, and accountability across the entire gamut of operation of our Company. It is significant because it promotes culture of accountability and transparency, enhances investor confidence, facilitates efficient risk management, encourages ethical behaviour, focusses on long-term value creation, ensures regulatory compliances and takes care of interest of all stakeholders. By establishing effective governance practices, companies can build trust, attract investment, and achieve sustainable growth.

Leadership Team

The Board of Uno Minda plays a pivotal role in ensuring good governance within the organisation. It sets the ‘tone at the top’ and a corporate culture that promotes ethical conduct on the part of the organisation and its employees. The Company has adopted a Code of Conduct for Board of Directors, Senior Management Personnel and all employees of Uno Minda Group that lays down the appropriate & rightful conduct of our effective and responsive Board and a vastly experienced senior management team.

The Board is responsible for setting the strategic direction, overseeing management, and ensuring that the Company operates in the best interests of all its stakeholders. The board periodically reviews the business strategy of the Company to ensure that it is responsive to the ever-changing external environment and in alignment with the Company’s mission and long-term aspirations

Board Composition

The Company’s Board always has members from diverse fields who have contributed to the growth and performance of the Company. The Company has been following a practice of inducting new Independent Board Members from diverse field considering the knowledge, skill and experience requirement of the Company which not only enhances the knowledge and experience pool of the Board but also enables to have new thought process to meet dynamic business requirement. Our commitment is operationalised through our Board Diversity Policy.

Board Details as of 15 June 2023

9

Members

5

Independent Directors

11%

Women Directors

22%

Directors Elected Annually

64

Years Average Age

Committees at Uno Minda

Audit Committee

Corporate Social Responsibility Committee

Stakeholders’ Relationship Committee

Risk Management Committee

Nomination and Remuneration Committee

Investment Committee

Corporate Governance Mechanism

The governance model is formalised and operationalised through a diverse set of policies, procedures, and process-driven systems that have been institutionalised throughout the Company. The policies help govern various aspects of the business and ensure compliance with legal, ethical, and operational standards. Our corporate governance policies ensure transparency in operations, timely disclosures, and adherence to regulatory compliances. These policies are regularly updated on the basis of feedback received from stakeholders, emerging workplace trends, regulatory changed and global good practices. Overall, well-crafted, and effectively implemented policies contribute to the smooth operation, compliance, and success of a business, while promoting ethical behaviour, consistency, and stakeholder trust.

Our codes and policies are available to all our stakeholders including our employees on internal and external communication portals. Familiarity with the codes and policies is provided as a part of the induction and refersher training is driven through the learning and development framework.

- Leadership through Board of Directors

- Second level executive leadership team

- Important systems of financial control, compliance management , risk management, internal control systems interacting with each other

- Subsequent layer of risk analysis, goal creating, objective setting, activities and monitoring of activities

- Audit and internal control processes and base layer

Alignment with G20/ OECD Principles of Corporate Governance

The G20/OECD Principles of Corporate Governance help policy makers evaluate and improve the legal, regulatory, and institutional framework for corporate governance, with a view to support economic efficiency, sustainable growth and financial stability.

Corporate governance practices at Uno Minda Group are benchmarked by the Organisation for Economic Cooperation and Development (OECD) as follows:

| Principle 1 | Principle 2 | Principle 3 | Principle 4 | Principle 5 | Principle 6 |

|---|---|---|---|---|---|

| Ensuring the basis for an effective corporate governance framework | The rights and equitable treatment of shareholders and key ownership functions | Institutional investors, stock markets, and other intermediaries | The role of stakeholders in corporate governance | Disclosure and transparency | The responsibilities of the board |

| The corporate governance framework should be consistent with the rule of law and support effective supervision | Corporate governance framework should protect and facilitate the exercise of shareholders’ rights and ensure the equitable treatment of all shareholder. All shareholders must have means to effective redressal of grievance | Corporate governance should ensure fair disclosure, and due compliance of listing regulations | Corporate governance should focus on all stakeholders and have effective vigil mechanism | Corporate governance should ensure that timely and accurate disclosure is made on all material matters including financial situation, performance, ownership and governance | The corporate governance framework should ensure the strategic guidance of the Company, the effective monitoring of management and accountability to shareholders |

Priinciple 1

Ensuring the basis for an effective corporate governance framework

- Uno Minda has always ensured that all it’s activities are consistent with applicable laws

- IT-based compliance tool has been implemented across the group including foreign entities to ensure due compliance of all applicable laws

- Regular updates are received from the service provider which gets mapped into the activity of the concerned person

- Regulatory compliances are also reviewed at various management level reviews

- Regulatory compliance status are also placed at the Audit Committee and Board meeting every quarter

- Internal Auditors, Secretarial Auditors also review regulatory compliances

- The Company has a system of educating and training its people for various regulatory changes

- Advise of advisors and consultants are obtained to ensure proper regulatory compliances

Principle 2

The rights and equitable treatment of shareholders and key ownership functions

- Uno Minda has always ensured to treat all shareholders equitably and that they are able to exercise their rights

- E-voting facility has been provided on all resolutions

- All shareholders on first come first serve basis had been afforded opportunity to ask questions to management at all annual general meeting (AGM). At the AGM held on 16th September, 2022 all 14 shareholders who had sent their request upto the cut-off date were given opportunity to speak and raise queries to the management. Apart from the said 14 shareholders all other shareholders were given facility to raise queries through chat box as the AGM was held through video conferencing

- Live video streaming of 30th AGM over YouTube was provided for benefit of members

- Proper disclosure of all material information in explanatory statement was ensured. Even certain disclosure requirement as suggested by proxy advisory forms were to the extent applicable and possible had also been discloses

- The capital structure has only one class of equity share capital

- The Company has put-in escalation matrix in its ‘Investor Grievance Redressal and Escalation Mechanism’ which is available in website under Investor Section

- All related party transactions are carried out at arm’s length basis and reported to stock exchanges

Principle 3

Institutional investors, stock markets, and other intermediaries

- The Company has always ensured fair disclosure and due compliance of all disclosure requirements of the listing regulations

- From time to time the Company’s officials meet representative of institutional investors and respond to their queries, while maintaining that no UPSI is shares selectively

- In case any response is required to proxy advisory reports which are referred by institutional investors the same is given to the proxy advisors

Principle 4

The role of stakeholders in corporate governance

- Uno Minda has always focussed that operations are carried out keeping in mind interest of all stakeholders.

- Business Partners -Customers & Vendors and channel partner engagement though annual meet apart from individual meet, survey, and regular contact etc., are some of the channels of engagement

- Employees are engaged through various communication channels and the Company’s internal online system. Employee satisfaction and engagement survey are also conducted. This helps to understand the expectations and enhances engagement levels

- Interest of society is also focussed. Engagement via regular community visit, CSR activities aligned with society’s needs and impact assessment helps to address interest of society

- Effective vigil mechanism process provides opportunity to all stakeholders to raise concern about any unethical practices which come to their knowledge. Vigil mechanism is monitored by dedicated committee and reported to Audit Committee

Principle 5

Disclosure and transparency

- Uno Minda has always believed in fair and transparent disclosure

- Adequate and timely disclosure of all material events are made to the stock exchanges

- Website of the Company has all relevant material information and is regularly updated

- Every quarter investor concalls and meets are organised providing opportunity to investors to interact and raise queries

- The Company has started to send integrated reporting from FY 2021-22 and this year’s annual report is also an integrated report which has apart from statutory reports viz Board Report, Auditors’ Report and Standalone and Consolidated Financial statement other relevant information

Principle 6

The responsibilities of the Board

- All information including budgets, detailed project report, business structuring transactions such as mergers and acquisitions, major capex, investment, financial performance & comparison with industry performance, related party transactions etc, are placed before the Board and Audit Committee

- Corporate strategy and risk management is specifically reviewed by Risk Management Committee

- Nomination and Remuneration Committee ensures board diversity and approves executive pay including senior management

- The Board through Audit Committee supervises the overall accounting and financial reporting systems, audit, internal financial controls to ensure true and fair financial reporting

- The Board process including its Committees are such which ensures that all responsibilities and functions as stipulated in statute are complied with

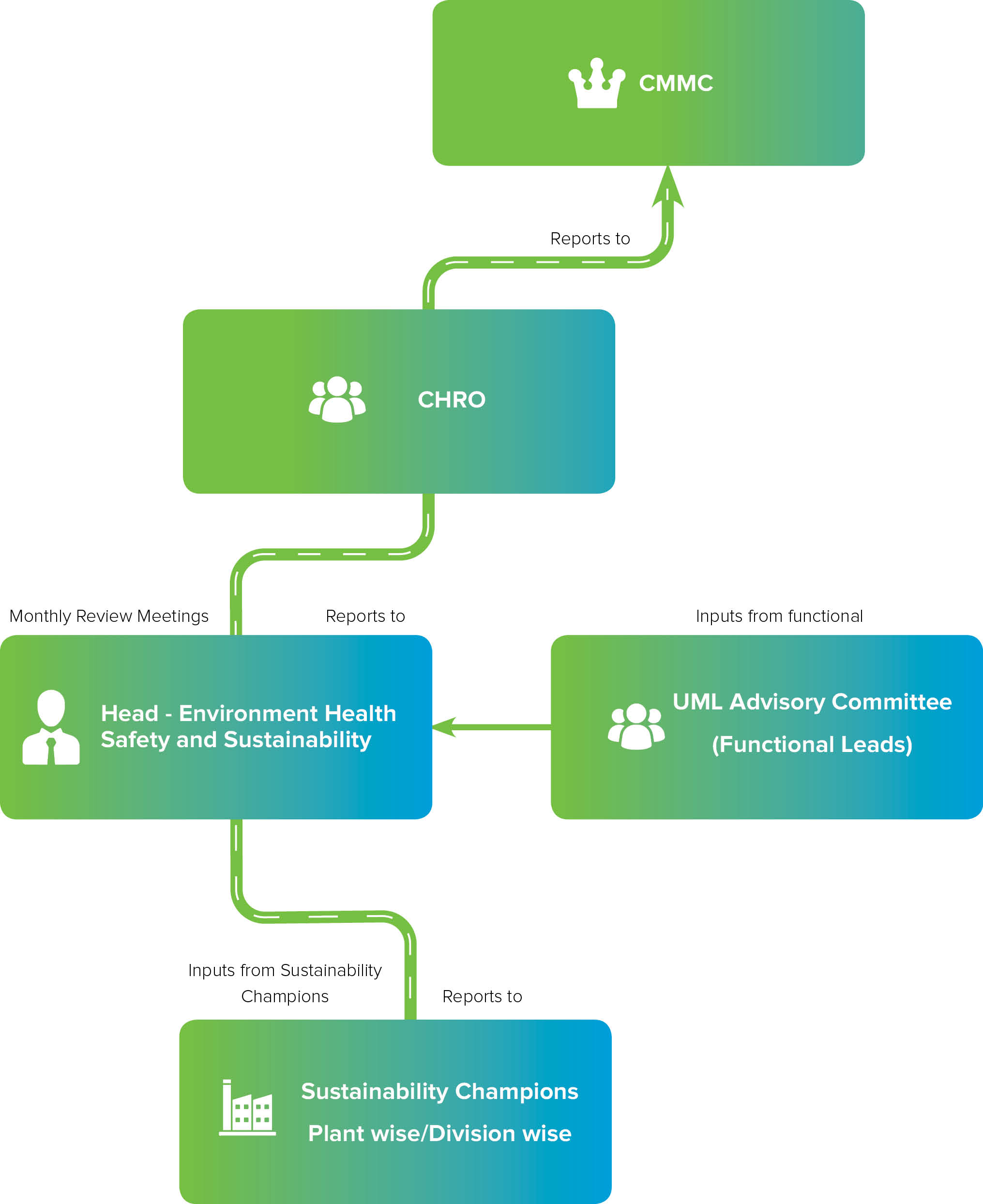

Sustainability Governance Structure

As the auto industry expands, sustainability considerations have become increasingly crucial for auto industry companies and all other stakeholders. In response, we established a governance system that evaluates the Company’s Environmental, Social, and Governance (ESG) performance as well as the significant risks and opportunities associated with it..