Corporate Overview

- About the Report

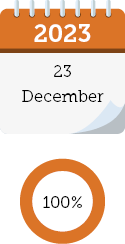

- Progress Snapshots FY 2023-24

- Awards and Recognitions

- Value Creation Highlights

- Uno Minda Group

- Presence across Continents

- Journey Towards Eminence

- Strong Partnerships

- Financial Momentum

- Leadership and Governance at Uno Minda

- Sustainable Governance Structure

- Board of Directors

- Letter from the CMD

- CFO’s Thoughts

- Value Creation Model

- Materiality Assessment

- Navigating the Uncertain: Risks and Opportunities

- Risk Assessment Matrix

- Strategy to Mitigate Risk

- Planet

- People

- Products

- Process

- Profit

- ESG Roadmap

- Corporate Information