Materiality Assessment

Materiality assessment is a systematic evaluation of environmental, social, and governance factors that are relevant and significant to a company's business operations and stakeholders. It involves identifying and prioritising ESG issues based on their potential impact on the company's long-term value creation, reputation, and sustainability. The assessment considers various aspects such as climate change, resource management, labour practices, human rights, board diversity, and corporate governance. By conducting a materiality assessment, companies gain insights into the issues that matter most to their stakeholders, enabling them to develop effective strategies, set goals, and allocate resources to address these concerns. It serves as a guiding framework for integrating sustainability into business practices, decision-making, and reporting, ultimately fostering responsible and resilient business models.

Uno Minda Group conducts a materiality assessment to identify topics that are important to its stakeholders. This includes factors such as the Company's industry outlook, major trends, and risk perspectives. We are committed to responsible growth and believe that openness to collaboration and improvement can help build reputation and trust among stakeholders. This, in turn, can support growth.

We conducted our last comprehensive review of materiality analysis in FY 2021-22. This involved consulting with stakeholders, subject matter experts, and business function heads to identify sustainability issues and map out potential risks and opportunities. Particular attention was paid to the financial impact of emerging ESG risks and opportunities. The group has established an enterprise risk management framework that enables it to identify and manage ESG risks. ESG risks are a central part of the assessment process because they can have a significant impact on the Company's business model, value drivers, and financial performance. This assessment is planned to be conducted periodically and material issues are updated based on an analysis of stakeholders’ views, as well as the prevalent market, regulatory and environmental trends.

In FY 2022-23, the top management reviewed material issues Through an internal they prioritised key material topics based on their significance in business operations for strategy management and execution

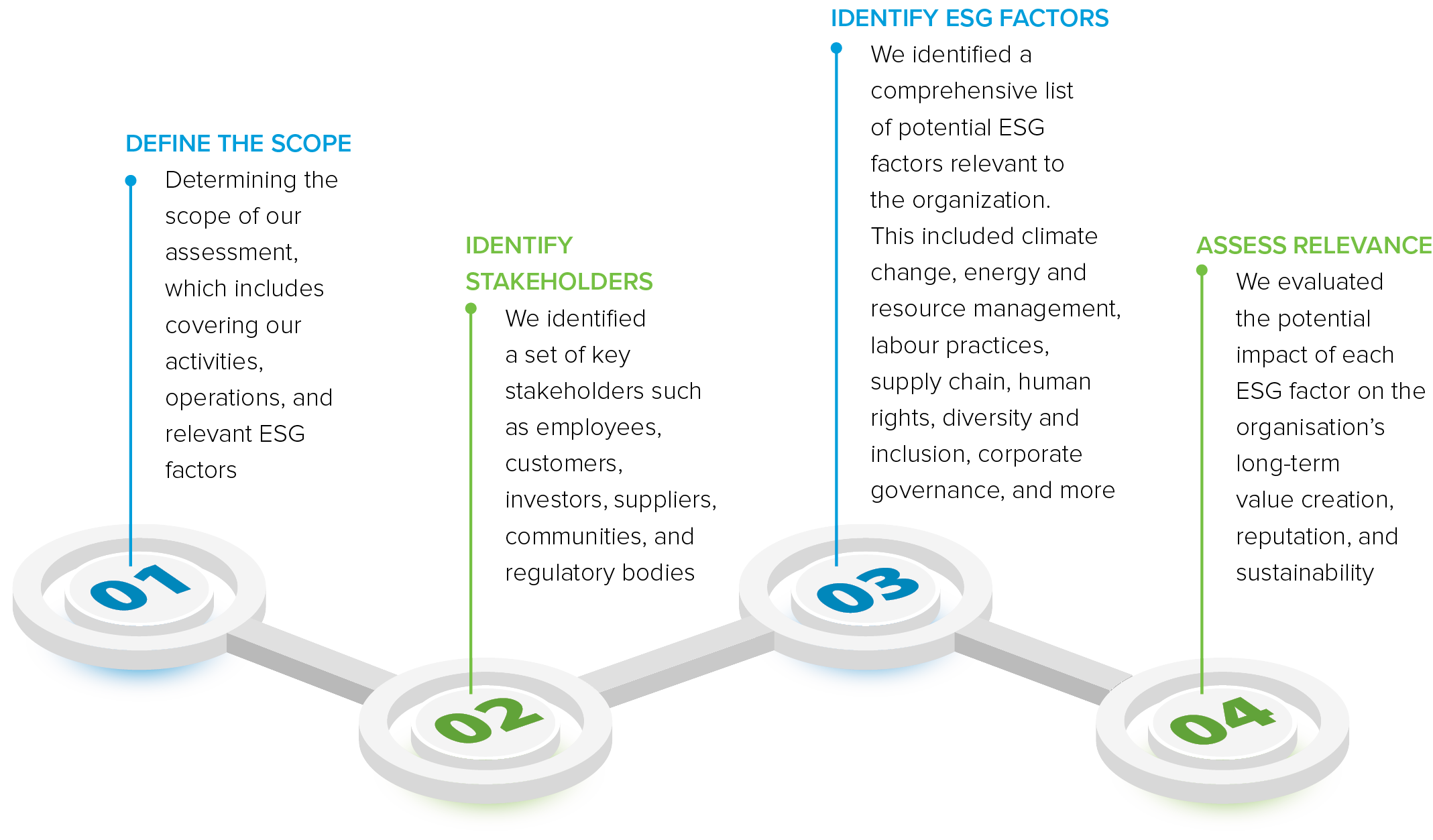

Conducting an ESG materiality assessment involved several key steps.

The Uno Minda Group identified all possible list of material topics that it considers important to its stakeholders. In order to prioritise these topics, we used a multi-step process that included:

Internal assessment

The Group assessed its own performance on the material topics. This included collecting data, conducting analysis, and identifying trends.

Relevance and significance

The Group considered the relevance and significance of the topics to its business and stakeholders.

Expert judgment

The Group drew on the expertise of its employees, advisors, and other stakeholders to make judgments about the materiality of the topics.

Sustainability

The Group considered the sustainability of the topics, both in terms of their impact on the environment and society, and their ability to create long-term value for the Group.

We strive to continuously monitor and review the materiality assessment exercise to stay abreast of evolving ESG trends, stakeholder expectations, and regulatory changes.

Top material issue identified were:

| Material Topics | Relevance to the Company | Boundary | Associated Capital | Alignment with SDGs |

|---|---|---|---|---|

| Energy Management and Energy Transition | Optimise energy use across the operations and move to renewable energy (solar or wind power) | Uno Minda Group | Natural Capital | Goal 7: Affordable and Clean Energy |

| GHG Emission Management | Reduce GHG emissions to achieve net zero target | Uno Minda Group | Natural Capital | Goal 13: Climate Action |

| Water Management | Managing water resources to be equitable, available and effectively manage a company’s operations | Uno Minda Group | Natural Capital | Goal 6: Clean Water and Sanitation for all |

| Waste Management | Transition from a linear to circular economy and to preserving the health and safety of communities and the environment | Uno Minda Group | Natural Capital | Goal 12: Responsible Consumption and Production |

| Product Life Cycle Management and Product Quality Management | Help Company understand product carbon footprint, energy consumption, waste generation, ecosystem risks, and optimise resources for sustainable development, regulatory compliance, and cost reduction. To ensure management structure to retain and enhance quality | Uno Minda Group and Suppliers | Natural Capital Manufactured Capital | Goal 12: Responsible Consumption and Production |

| Human Resource Management and Employee Engagement | Enable company to prioritise investments in human capital, cultivate a strong company culture, and build a motivated workforce that drives sustainable business performance | Uno Minda Group | Human Capital | Goal 8: Decent Work and Economic Growth |

| Occupational Health and Safety (OHS) | Prioritises workplace health and safety for sustainable organisational growth and employee well-being | Uno Minda Group and Suppliers | Human Capital | Goal 3: Good Health and Well-Being Goal 8: Decent Work and Economic Growth |

| Human Rights (including Diversity, Equality, & Inclusion) | Individual and stakeholder rights are important to Uno Minda, and they are protected throughout the value chain. | Uno Minda Group and Suppliers | Human Capital | Goal 5: Gender Equality Goal 8: Decent Work and Economic Growth Goal 10: Reduced Inequalities |

| Corporate Social Responsibility (CSR) | Uno Minda’s culture values community welfare, promoting better living and enabling better living in the vicinity of operations and destinations through various initiatives across the country | Uno Minda Group | Social and Relationship Capital | Goal 11: Sustainable Cities and Communities Goal 17: Partnerships for the Goals |

| Responsible and Sustainable Supply Chain | Maintain a long-term impact, lower reputational risks, and improve operational efficiency, allowing for a long-term impact beyond operational bounds | Uno Minda Group and Suppliers | Social and Relationship Capital Natural Capital | Goal 8: Decent Work and Economic Growth Goal 12: Responsible Consumption and Production |

| Emerging Technologies | Accelerate constant innovation which drives new offerings addressing evolving client preferences and market demands | Uno Minda Group and Suppliers | Intellectual Capital Manufactured Capital | Goal 9: Industry, Innovation and Infrastructure |

| Economic Value Creation | Create economic value to preserve and enhance financial interests of stakeholders | Uno Minda Group, Investors and Shareholders | Financial Capital | Goal 8: Decent Work and Economic Growth |

| Regulatory Compliance | Maintaining image of Uno Minda group as responsible corporate which is fully compliant with regional, national and international laws and regulations | Uno Minda Group | Financial Capital Manufacturing Capital Social and Relationship Capital | Goal 16: Peace, Justice and Strong Institutions |

Materiality topics important for stakeholders

| Material Topics | Stakeholder |

|---|---|

| Energy Management and Energy Transition | Investors, Regulators and Customers |

| GHG Emission Management | Investors, Community, Regulators, Civil Society, Customers |

| Water Management | Community, Regulators, Customers |

| Waste Management | Investors, Employees, Regulators, Civil Society |

| Product Life Cycle Assessment | Regulators, Customers |

| Human Resource Management and Employee Engagement | Employees |

| Occupational Health and Safety (OHS) | Investors, Employees, Regulators |

| Human Rights (including Diversity, Equality, & Inclusion) | Investors, Regulators, Employees, Community, Suppliers |

| Corporate Social Responsibility (CSR) | Communities, Civil Society, Regulators |

| Responsible and Sustainable Supply Chain | Suppliers, Customers, Regulators |

| Emerging Technologies | Investors, Suppliers, Customers |

| Economic Value Creation | Investors and Shareholders |

| Regulatory Compliance | Customers. Investors,Community and Regulators |